- BlockFi vs. Crypto.com: Key Information

- Company Bios: BlockFi vs. Crypto.com

- Feature #1: Interest Rates: Who Pays More, BlockFi or Crypto.com?

- How Do BlockFi and Crypto.com Make Money?

- Feature #2: Payouts and Withdrawals

- Feature #3: BlockFi vs. Crypto.com Security

- Feature #4: Ease of Use

- BlockFi vs. Crypto.com Standout Features

- The Court of Public Opinion: BlockFi vs. Crypto.com Reddit

- BlockFi vs. Crypto.com Customer Support

- Can You Trust BlockFi and Crypto.com?

- BlockFi vs. Crypto.com: Which is the Better Crypto Interest Account?

Editor’s note: During the bulk of its operations, BlockFi was regarded as a top-tier product, at least in the cryptocurrency industry; it was considered to be safe, and its executive team pledged to keep user funds safe. By November 2022, BlockFi had no choice but to block all customers from withdrawing their assets due to its complex financial relationship with FTX and FTX affiliate hedge fund Alameda Research.

If you’re weighing your cryptocurrency interest account options, Blockfi vs. Crypto.com is a strong first comparison.

BlockFi is based in the U.S. and is viewed as a CeFi staple. It’s easy to get started, highly-trusted within the cryptocurrency community, and offers above-average yields across coins like BTC, ETH, and USDC.

BlockFi has an exchange, interest account, and credit card that all seamlessly pair together.

Crypto.com is based in Hong Kong and has established itself as a pioneer in what it does, which is seemingly everything. Its products include an exchange, interest account, staking platform, NFT storage platform, credit card, and more.

While Crypto.com offers some of the highest APY for its interest account, it requires its users to jump through many hoops and hold significant amounts of its native token, CRO, to get them.

Our full BlockFi vs. Crypto.com comparison includes everything you need to know about rates, security, public trust, and more.

Let’s get started.

BlockFi vs. Crypto.com: Key Information

| BlockFi | Crypto.com | |

| Reviews | BlockFi Review | Crypto.com Review |

| Site Type | Cryptocurrency interest account + basic exchange | Crypto exchange + crypto interest account + NFT exchange |

| Beginner Friendly | Yes | Yes |

| Mobile App | Yes | Yes |

| Buy/Deposit Methods | ACH, wire transfers,crypto deposits | ACH, wire transfers, PayPal, credit or debit card |

| Sell/Withdrawal Methods | External crypto wallet, bank account | External crypto wallet transfer, ACH |

| Available Cryptocurrencies | Bitcoin, Ethereum, Litecoin, Link + stablecoins | Bitcoin, Ethereum, Dogecoin, stablecoins, other altcoins |

| Company Launch | 2017 | 2016 |

| Location | Jersey City, NJ, USA | Hong Kong |

| Community Trust | Poor | Great |

| Security | Great | Great |

| Customer Support | Good | Great |

| Verification Required (KYC) | Yes | Yes |

| Fees | Medium | Average |

| Site + Promo | The company is bankrupt | Earn up to $25 on Crypto.com |

Company Bios: BlockFi vs. Crypto.com

BlockFi was founded in 2017 by Zac Prince and Flori Marquez. It’s headquartered in New Jersey and has received investments from several big names in the Fintech and cryptocurrency industries, including SoFi, Winklevoss Capital, and Pomp Investments.

BlockFi’s latest round of funding took place in March 2021, in which it raised $350 million at a $3 billion valuation. The company has around $15 billion in assets under management (AUM).

Crypto.com was launched in Hong Kong under the name Monaco Technologies in June 2016 but rebranded in July 2018 to its current name. The company grew quickly, as it was accepted into a Hong Kong-government-backed cryptocurrency incubation program called SuperCharger in 2017.

Crypto.com is led by CEO Kris Marszalek and CFO Rafael Melo. Its team is full of alumni from some of the biggest names in both traditional finance and cryptocurrency, including:

- Deutsche Bank

- JP Morgan

- PayPal

- Binance

Feature #1: Interest Rates: Who Pays More, BlockFi or Crypto.com?

Both Crypto.com and BlockFi paid users interest on the cryptocurrency assets they store on the platform.

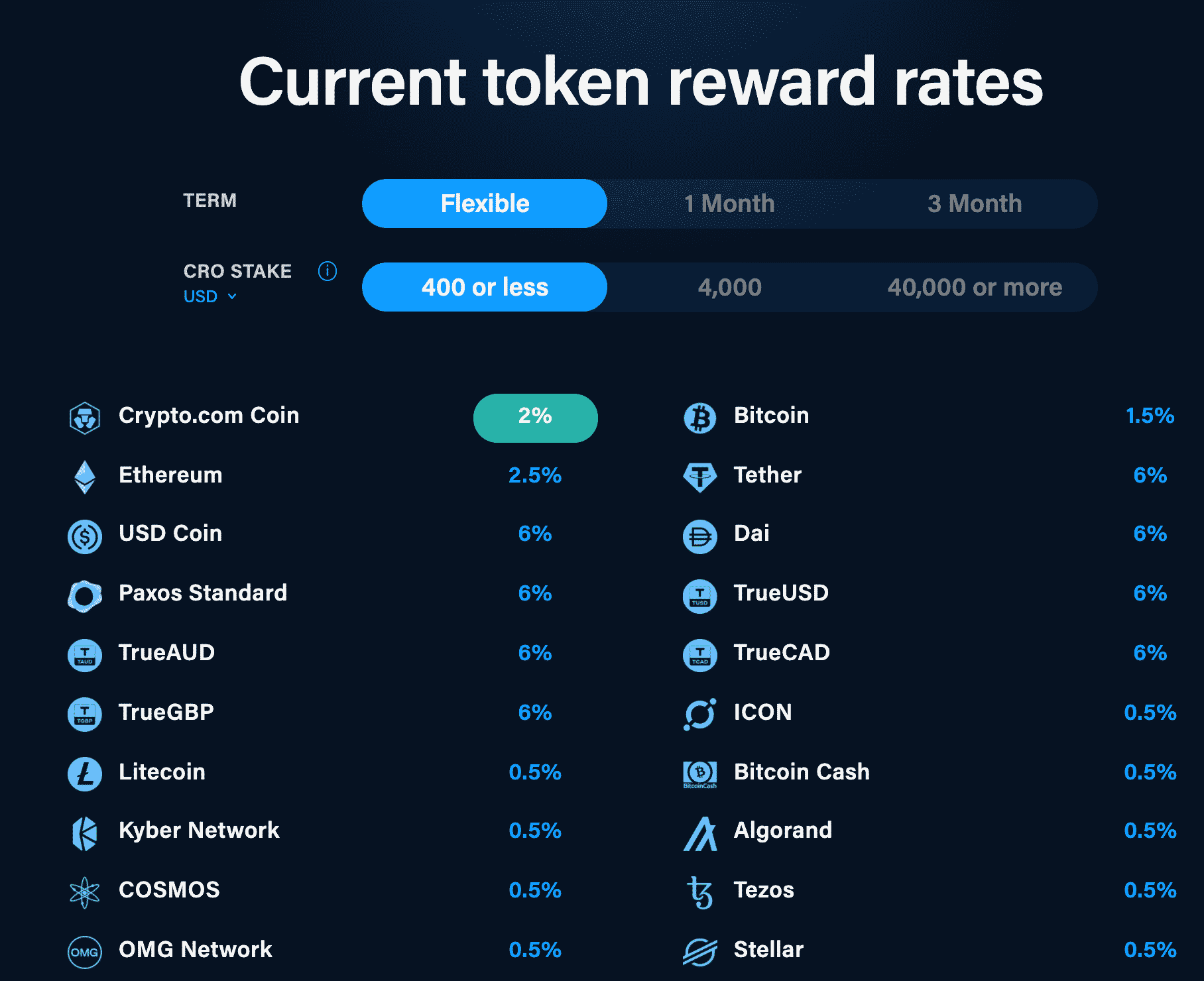

Crypto.com’s system is much more complicated, with plenty of opportunities to get confused. Crypto.com Rates vary based on whether a user chooses a flexible, 1-month, or 3-month term. Further, users need to own Crypto.com’s token (CRO) to earn the maximum interest. Rates scale up based on the tiers of CRO holdings:

- $400 or less in CRO

- $401 to $4,000 in CRO

- $4,001 to $40,000 or more in CRO

- $40,001 to $400,000 in CRO

Keep in mind that these CRO amounts are in dollar amounts– as in you will need to buy $400,000 worth of CRO to unlock the highest tier.

Let’s see how this plays out with some examples.

Bitcoin

- BlockFi uses a tiered interest-rate system for Bitcoin; APY scales based on how much BTC you store on the platform. Rates are around 4% for 0 – 0.25 BTC, 1.5% for 0.25 – 5 BTC, and 0.25% for > 5 BTC, but are subject to change.

- Crypto.com’s BTC rates range from as low as 1.5% for a flexible account with less than $400 in CRO to as high as 8.5% for a user with $40,000 or more in CRO with a 3-month account.

Ethereum

- BlockFi also uses a tiered interest-rate system for Ethereum. Current rates are 4% for 0 to 5 ETH, 1.5% for 5 to 50 ETH, and 0.25% for > 50 ETH.

- Crypto.com’s Ethereum rates start at 3.5% for a flexible user with $400 or less in CRO and go up to 8.5% for a 3-month user with more than $40,000 in CRO.

Alts

| Coin Name | BlockFi | Crypto.com |

| Chainlink | 3% (0 – 750 LINK), 0.5% (>750 LINK) | 0.5% – 5% |

| Bitcoin Cash | N/A | 0.5% – 5% |

| Compound | N/A | 0.5% – 5% |

| Cosmos | N/A | 0.5% – 5% |

| UNI | 3.75% (0 – 750 UNI), 1.5% (> 750 UNI) | 0.5% – 5% |

| Dogecoin | N/A | 0.5% – 5% |

| Litecoin | 4.5% (0 – 100 LTC), 2% ( >100 LTC) | 0.5% – 5% |

| Polkadot | N/A | 6% – 14.5% |

Stablecoins

| Coin | BlockFi | Crypto.com |

| Tether | 7.5% (0 – 50,000), 5% (> 50,000) | 6% – 8.5% |

| GUSD | 7.5% (0 – 50,000), 5% (> 50,000) | N/A |

| USDC | 7.5% (0 – 50,000), 5% (> 50,000) | 6% – 14% |

Winner: BlockFi. BlockFi’s simplicity and competitive rates carry the day.

Although Crypto.com offers higher top-end rates than BlockFi on most coins, it’s asking a lot from its users. Holding $40,000 to $400,000 worth of an arguably dubious token like CRO may seem unrealistic and unnecessary for most users. In other words, Crypto.com’s juice isn’t worth the squeeze, particularly when a platform like BlockFi (or Celsius) offers comparably high rates without the complexity.

CoinCentral readers can earn up to $250 by signing up for BlockFi.

How Do BlockFi and Crypto.com Make Money?

BlockFi makes its money by lending out the assets it holds for less than it pays its users for them. For example, it might offer 7.5% on Tether (USDT) but lend it out for 12%. These loans are over-collateralized so the risk of default is relatively low.

Crypto.com makes its money through both loans and exchange fees. The company’s loaning system works similarly to BlockFi’s. It uses a complex maker/taker fee structure for crypto trading, with maker rates ranging from 0.036% to 0.1% and taker rates ranging from 0.090% to 0.16%.

Feature #2: Payouts and Withdrawals

BlockFi interest accrues daily and is paid out on a monthly basis. Many of its competitors pay out interest daily. BlockFi users are entitled to one free crypto withdrawal and one free stablecoin withdrawal each month. Additional withdrawals incur a fee.

Crypto.com charges fees for all withdrawals that are completed on-chain. Users can avoid these fees by using the company’s withdraw to app function. That being said, there is no fee to send cryptocurrency to other Crypto.com users.

Crypto.com pays its interest out daily, however, this interest does not compound.

Winner: BlockFi. BlockFi wins this one due to its free withdrawal options and compounding interest. Crypto.com is a better choice for people who want their interest paid out immediately rather than monthly– however, beware the fees.

Feature #3: BlockFi vs. Crypto.com Security

Crypto.com and BlockFi appear to take users’ security seriously and neither has suffered a major breach that impacted clients’ funds.

BlockFi holds 95% of the funds it stores in cold storage. This is managed by Gemini, which holds a SOC certification from Deloitte.

Crypto.com is regularly audited by Bureau Veritas and has partnered with Ledger to cold store the vast majority of its users’ funds. It also uses hardware security modules and multi-signature technologies to keep assets secure.

Both companies have numerous user-facing security features such as 2-factor authentication.

Each offers FDIC insurance for up to $250,000 of its users’ cash funds– this is only for fiat, not stablecoins or cryptocurrency.

Winner: Crypto.com It’s difficult to distinguish a winner here, but Crypto.com gets the nod because it claims to store 100% of its users’ funds in cold storage, beating out BlockFi’s 95%.

Feature #4: Ease of Use

BlockFi is by far the easier of the two platforms to use; users simply need to move funds to BlockFi and sit back while the interest starts accruing.

Granted, Crypto.com users can do that too, but they won’t get the best rates unless they also purchase a non-insignificant sum of CRO tokens. This introduces a new element of risk into the equation that BlockFi doesn’t force upon its users. Further, Crypto.com users need to lock up their funds to get the best rates.

Celsius is similar to Crypto.com in that it also has its own cryptocurrency (CEL). However, it doesn’t require users to lock their funds or hold a certain amount of CEL to earn the best rates.

CoinCentral readers can get $25 by signing up for Crypto.com and staking for the Ruby Card, and also take home up to a $50 BTC bonus by depositing $400 or more on Celsius for 30 days.

BlockFi vs. Crypto.com Standout Features

Crypto.com and BlockFi have a similar standout feature: a cryptocurrency credit card.

Both the BlockFi credit card and Crypto.com credit card allow users to earn interest in crypto on everyday purchases.

However, as one may assume based on other points throughout this BlockFi. vs. Crypto.com review, BlockFi’s credit card is much simpler to use.

BlockFi’s card is free to apply for, it has no annual fee, and it doesn’t require jumping through hoops to get its maximum advantage.

Crypto.com offers several variations of its credit cards at different tiers, with rewards that range from 1% to 8% based on the amount of CRO a user holds. An individual needs to hold at least $400,000 in CRO to qualify for the highest interest rates.

The Court of Public Opinion: BlockFi vs. Crypto.com Reddit

People on Reddit are generally complimentary of both BlockFi and Crypto.com. The general consensus is that each platform is safe to use and offers excellent yield-earning opportunities.

Some people on Reddit have suggested spreading your funds across both of these platforms and Celsius. That way, if something were to happen to one of the platforms, you wouldn’t be impacted as negatively.

BlockFi vs. Crypto.com Customer Support

BlockFi has live phone support available from 9:30 AM – 5 PM EST. The company also has an online FAQ page users can visit to get answers to commonly-asked questions.

Crypto.com has a help center with answers to common questions. The company also has email support available at [email protected].

Can You Trust BlockFi and Crypto.com?

The common consensus is that both BlockFi and Crypto.com are both trustworthy. Each company claims to use cold storage for user funds, which keeps them away from internet-based security risks.

That being said, crypto interest accounts aren’t risk-free and should not be viewed as if they were savings accounts. Digital assets like BTC and USDC aren’t FDIC insured.

Further, these companies lend your cryptocurrency to third parties. Although they take precautions to over-collateralize their loans, there is still a risk involved when you don’t have custody of your digital asset.s

BlockFi has received recognition for its security practices from trusted names like Deloitte and the New York Department of Financial Services.

Crypto.com has earned an ISO/IEC 27001:3013 certification and is regularly audited by Bureau Veritas.

BlockFi vs. Crypto.com: Which is the Better Crypto Interest Account?

Crypto.com is still in business, whereas BlockFi was forced to lock people’s funds on its platform. Crypto.com power users wishing accept the risks that come with holding large amounts of CRO tokens, Crypto.com may be a sound option. When the token amounts and lock-up periods are maxed out, Crypto.com’s yields are some of the highest in the CeFi crypto interest account industry.

CoinCentral readers can earn up to $25 when staking for the Ruby Card.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.